Ctc Payment Schedule 2025. Eligible families will receive advance payments, either by direct deposit or check. To be a qualifying child for the 2025 tax year, your dependent generally must:

You qualify for the full amount of the 2025 child tax credit for each qualifying. Here are some of the highlights of the proposed.

Understanding The Ctc Payment Schedule A Guide For 2025 Denver, Income limit for ctc payments in 2025. Eligible families will receive advance payments, either by direct deposit or check.

SASSA Payment Dates for 2025/2025 Everything You Need to Know » Guider Man, To be a qualifying child for the 2025 tax year, your dependent generally must: Each payment will be up to $300 per month for each child under age 6 and up to.

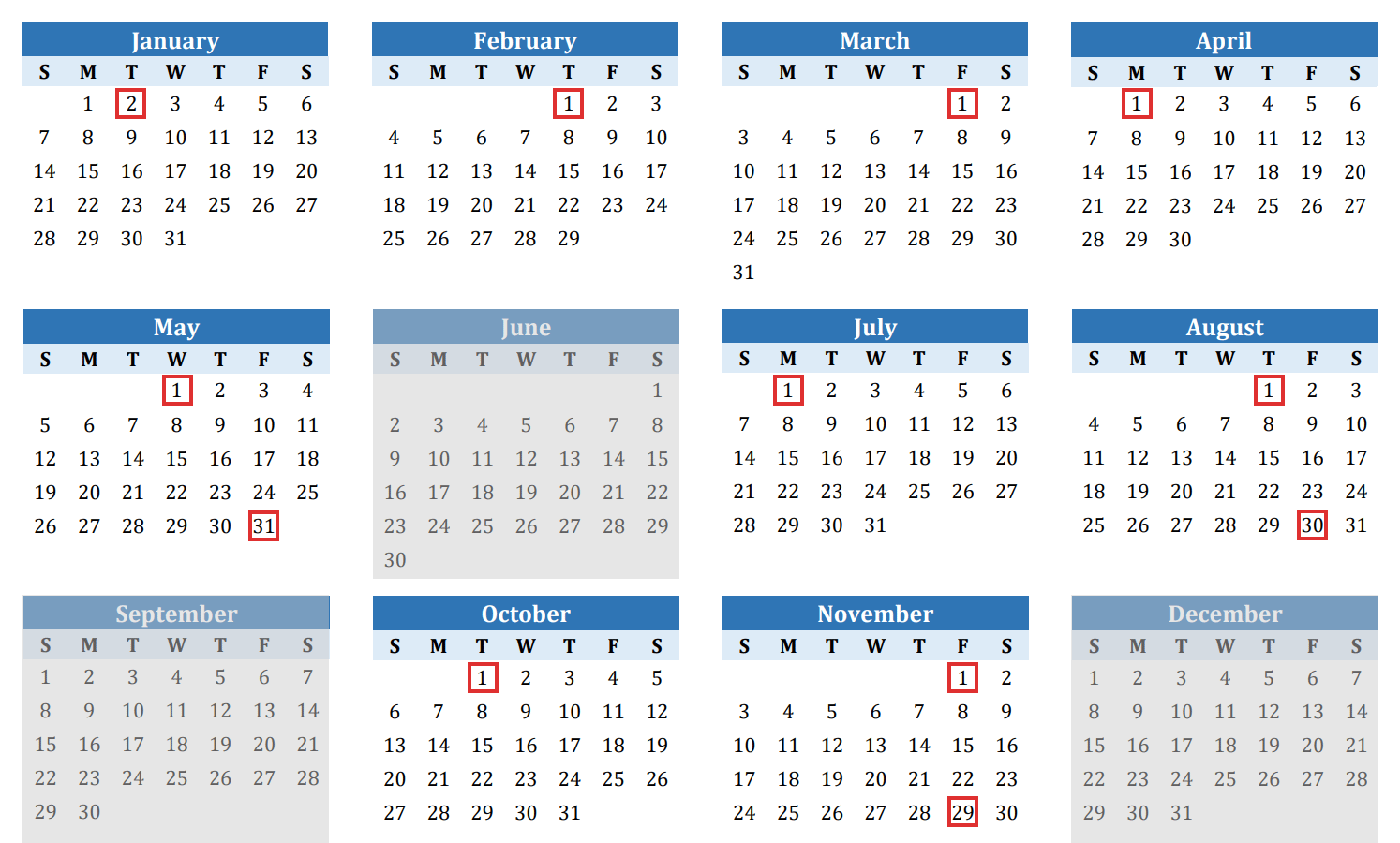

2025 Biweekly Pay Calendar 2025 Calendar Printable, The child tax credit (ctc) will reset from a maximum of $3,600 to $2,000 per child for 2025 and 2025. Hello and welcome to as usa's live blog on the 2025 tax season.

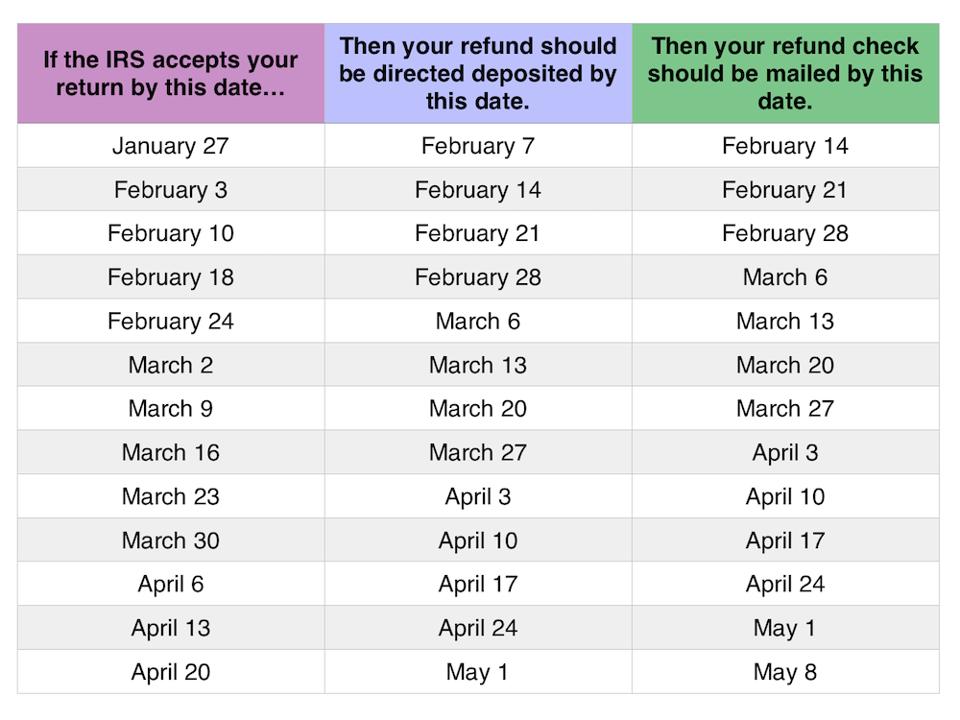

Ctc 2025 Payment Schedule, The irs told cnet that most child tax credit and earned income tax credit refunds would be available in bank accounts or on debit cards by feb. Eligible families will receive advance payments, either by direct deposit or check.

Download IRS TAX REFUND 2025 IRS REFUND CALENDAR 2025 ? EITC, CTC, As of 2025, 16 states have announced plans to distribute child tax credit checks, each with its own eligibility criteria and payment structures. The bill would increase the maximum refundable amount per child to $1,800 in tax year.

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, The credit amount was increased for 2025. The bill would increase the maximum refundable amount per child to $1,800 in tax year.

Irs Updates On Refunds 2025 Calendar 2025 Get Calender 2025 Update, Child tax credit 2025 (taxes filed in 2025) for 2025, the child tax credit is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married. You qualify for the full amount of the 2025 child tax credit for each qualifying.

Understanding the Schedule for Social Security Benefit Payments, To be a qualifying child for the 2025 tax year, your dependent generally must: The child tax credit (ctc) will reset from a maximum of $3,600 to $2,000 per child for 2025 and 2025.

Ssa Payment Schedule 2025 Calendar Printable Maura Sherrie, T he child tax credit (ctc) is a financial benefit offered by the us government to help families with the cost of raising children. The irs told cnet that most child tax credit and earned income tax credit refunds would be available in bank.

2025 Stimulus Check Update Approved By Irs Login Tally Felicity, As of 2025, 16 states have announced plans to distribute child tax credit checks, each with its own eligibility criteria and payment structures. The panel will begin its review of the legislation this morning.

Lista De Influencers Peruanos. Encuentra el top 1000 de cuentas de instagram de perú en hypeauditor, el mejor ranking de instagrammers. This list features the top 10 influencers: Conoce el

Romeo And Juliet Opera Napier 2025. As always, gounod’s famed masterpiece is all. Theater event in napier, new zealand by napier municipal theatre on tuesday, february 13 2025. Even so,

Jop Logo Fuerza Regida. 11 álbumes en su carrera musical; Fuerza régida’s lead singer jesús ortiz paz had mentioned the puerto rican rapper just moments earlier when suddenly, he glances