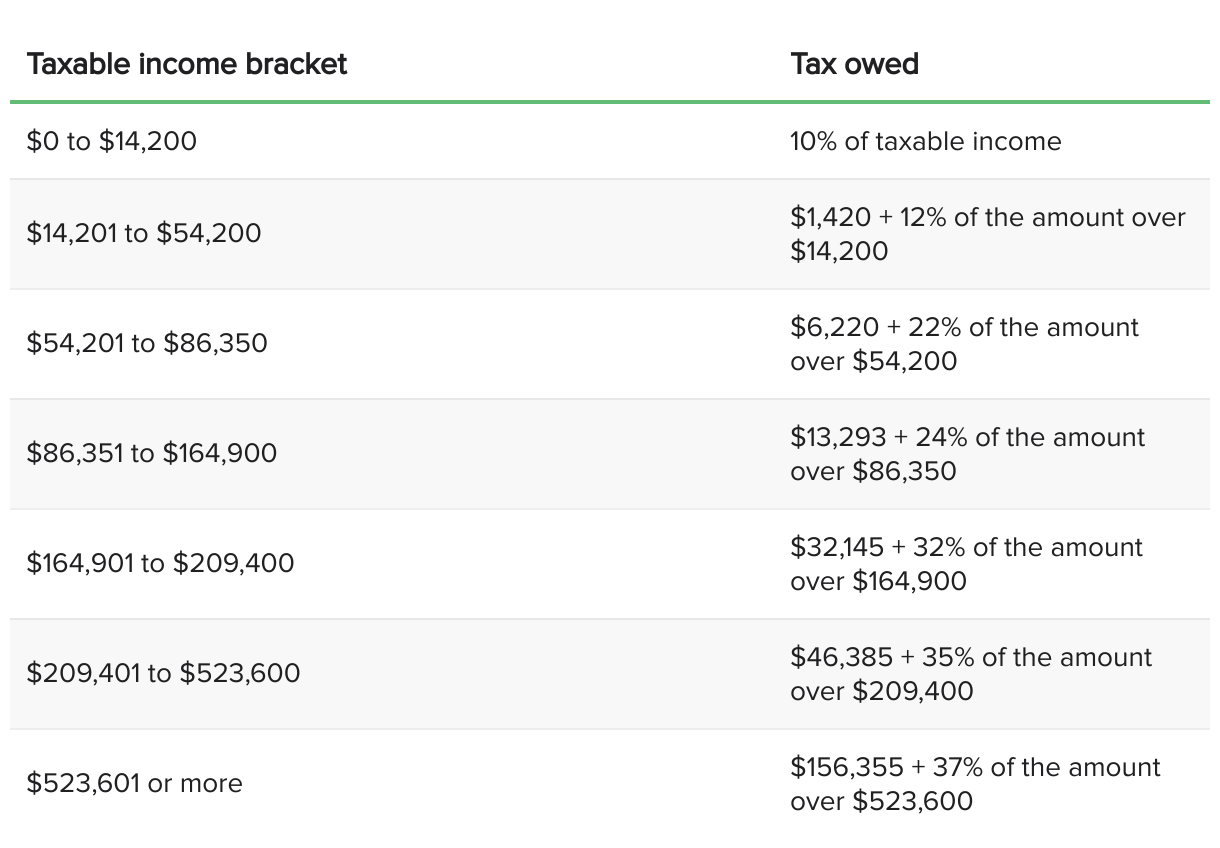

The income tax calculator estimates the refund or potential owed amount on a federal tax return. As your income goes up, the tax rate on the next layer of income is higher.

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married.

The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

2025 Tax Brackets Married Filing Separately Excited Elsy Christin, In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

2025 Tax Brackets Married Filing Separately Excited Codi Melosa, The last $52,850 will be taxed at 22%. The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

2025 Tax Brackets Married Filing Jointly Irs Shani Melessa, And is based on the tax brackets of. It is mainly intended for residents of the u.s.

2025 Tax Brackets Announced What’s Different?, Married filing separately tax brackets 2025. For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers.

2025 Tax Brackets Married Filing Separately 2025 Timmy Giuditta, For heads of households, the standard deduction will. It is mainly intended for residents of the u.s.

2025 Married Filing Separately Tax Brackets Milly Suzette, For the 2025 tax year, the standard deduction for married couples filing jointly is $27,700, nearly double the $13,850 deduction for those filing separately. The standard deduction for single filers or married couples filing separately is $14,600 for 2025, a $750 increase.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. For heads of households, the standard deduction will.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married. The next $35,550 will be taxed at 12%;

2025 Tax Brackets Married Filing Separately Married Filing Adele Antonie, Here’s how the math works: It is mainly intended for residents of the u.s.

Married Tax Brackets 2025 Pen Kathie, The 2025 standard deduction amounts are as follows: The first $11,600 of income will be taxed at 10%;